News & Updates

For the Securities Industry

Spicer Jeffries aims to serve our clients continuously with top quality, professional services. Continue to visit us here to read about important Securities Industry topics, regulatory changes, firm happenings and other updates.

Cherry Bekaert Bolsters Financial Services Practice with Strategic Acquisition of Spicer Jeffries LLP

October 7, 2025

Cherry Bekaert (the Firm) is pleased to announce the acquisition of Spicer Jeffries LLP (Spicer Jeffries), a leading CPA firm specializing in providing audit, tax, accounting and consulting services to the securities industry. For more than three decades, Spicer Jeffries and...

moreForeign Capital Gains Taxes – ACCOUNT FOR IT!

February 13, 2025

If your fund trades securities in foreign jurisdictions that tax capital gains, such as India, your fund must account for these capital gains taxes under the Accounting Standards Codification (ASC) 740 tax provision guide. This article explores how foreign capital...

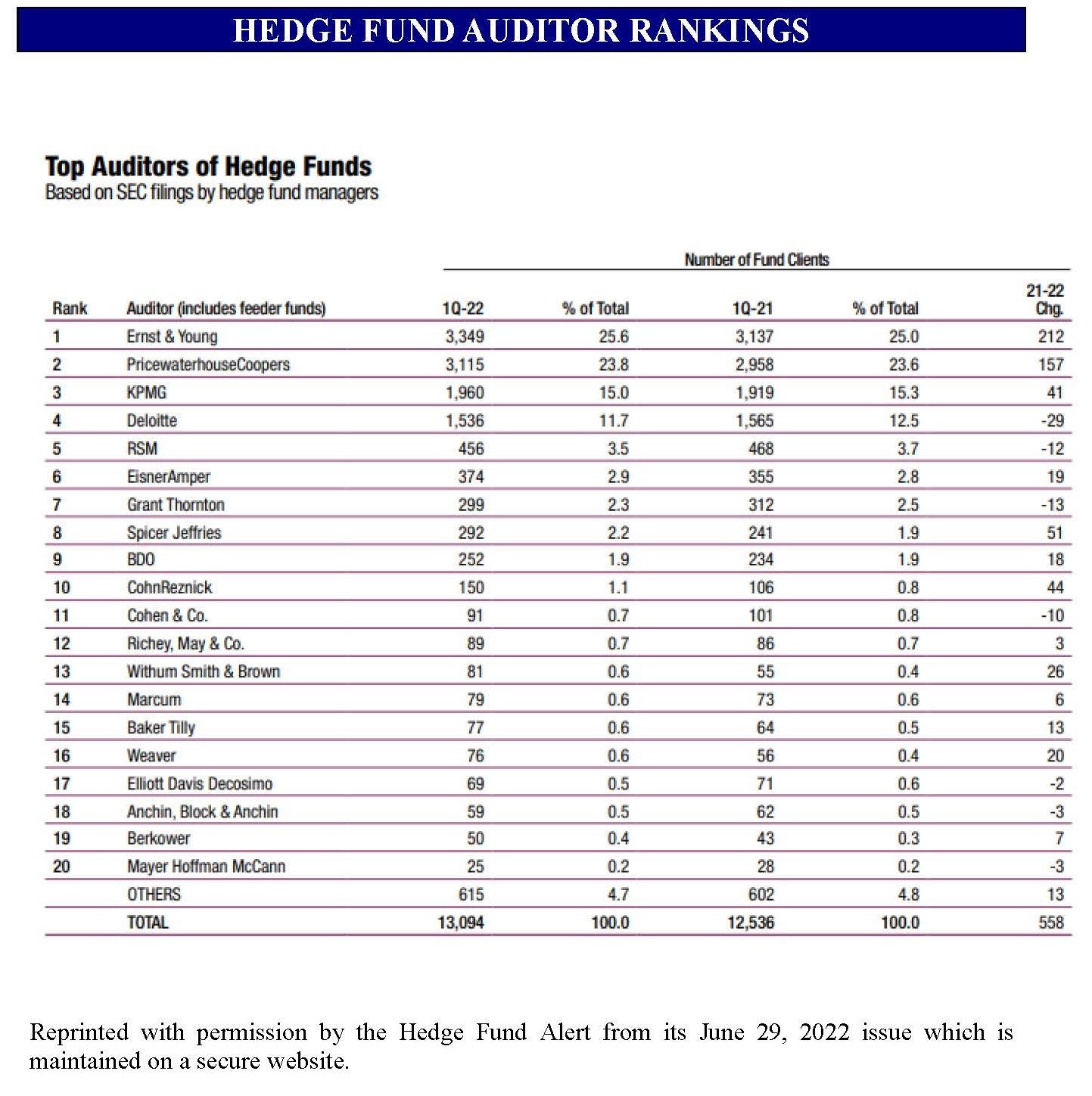

moreSpicer Jeffries Ranks Among TOP 10 Fund Auditors

August 15, 2022

For the 9th consecutive year, Spicer Jeffries LLP has ranked among the TOP 10 Fund Auditors of the HedgeFundAlert.com annual rankings. This success would not have been realized without the support of our valued clients and leading industry members, as...

moreNew York State: Pass-Through Entity Tax Law Article 24-A

August 31, 2021

The pass-through entity tax (PTET) under new Tax Law Article 24-A1 is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021. ...

moreIRS REVIVES FORM 1099-NEC: Filing Begins With 2020 Tax Year

January 8, 2021

As a reminder, the IRS made changes to the 1099-MISC form by reviving the Form 1099-NEC. Beginning with the 2020 tax year the new 1099-NEC form will be used for reporting nonemployee compensation (NEC) payments. These payments were previously reported on Form...

more