Related

Foreign Capital Gains Taxes – ACCOUNT FOR IT!

February 13, 2025If your fund trades securities in foreign jurisdictions that tax capital gains, such as India, your fund must account for these capital gains taxes under the Accounting Standards Codification (ASC) 740 tax provision guide. This article explores how foreign capital...

moreNew York State: Pass-Through Entity Tax Law Article 24-A

August 31, 2021The pass-through entity tax (PTET) under new Tax Law Article 24-A1 is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021. ...

moreCherry Bekaert Bolsters Financial Services Practice with Strategic Acquisition of Spicer Jeffries LLP

October 7, 2025Cherry Bekaert (the Firm) is pleased to announce the acquisition of Spicer Jeffries LLP (Spicer Jeffries), a leading CPA firm specializing in providing audit, tax, accounting and consulting services to the securities industry. For more than three decades, Spicer Jeffries and...

more2020 Tax Letter to Clients

December 16, 2020Dear Client, Now, as year-end approaches, is a good time to think about planning moves that may help lower your tax bill for this year and possibly next. Year-end planning for 2020 takes place during the COVID-19 pandemic, which in...

moreIRS REVIVES FORM 1099-NEC: Filing Begins With 2020 Tax Year

January 8, 2021As a reminder, the IRS made changes to the 1099-MISC form by reviving the Form 1099-NEC. Beginning with the 2020 tax year the new 1099-NEC form will be used for reporting nonemployee compensation (NEC) payments. These payments were previously reported on Form...

moreNEW CAYMAN ISLAND INVESTMENT FUND LEGISLATION – IMMEDIATE EFFECTS

April 17, 2020Changes to Cayman Investment Funds Classified as Private Funds and Mutual Funds Overview: The Cayman Islands Government Ministry of Financial Services and Home Affairs, together with other associated authorities (in particular, the Cayman Islands Monetary Authority “CIMA”) has notified the financial services industry of several pending changes to the regulation...

moreTAX FILING & PAYMENT DEADLINE POSTPONED

March 23, 2020The Treasury Department and IRS announced on March 21, 2020 that the federal income tax filing due date has been extended by Presidential signature of the Families First Coronavirus Response Act (H.R. 6201). The due date of April 15, 2020...

moreCryptocurrency Transactions – New IRS Guidelines

October 17, 2019The Internal Revenue Service (IRS) has issued new guidance for taxpayers engaging in transactions involving cryptocurrency. The recent IRS Revenue Ruling 2019-24 focuses on the tax treatment of a cryptocurrency hard fork. In addition, the FAQs on Virtual Currency Transactions...

moreTracking Your Success

August 1, 2019Investment performance tables and charts are an excellent way to track and showcase the success of your managed accounts and/or fund. Having a performance examination done on your monthly, annual and cumulative returns and comparing them to your benchmark provides...

moreAncillary Tax Services

July 9, 2019Spicer Jeffries’ tax department prepares tax documents for individuals and entities across the United States, in the Cayman Islands, and around the globe. Our client base spans numerous business segments and Spicer Jeffries understands that our client's businesses and private...

moreEmerging Manager Solution

August 9, 2019Spicer Jeffries’ partners have been involved with newly launched hedge and commodity funds, both registered and unregistered, as well as private equity funds and mutual funds, since the mid- 1980s. With years of previous accounting work experiences between them, and...

moreThree New Legislation Items for Fund Manager

May 9, 2019Spicer Jeffries wants our clients to be aware of the following legislation that has direct effects on Fund Managers: 1. CARRIED INTEREST - Incentive Allocation New Holding Period Requirement In general, the receipt of a capital interest for services provided to...

moreSpicer Jeffries Sponsors “Cryptocurrency Expert Panel”

August 15, 2018Spicer Jeffries hosted a "Cryptocurrency Expert Panel" for the Palm Beach Hedge Fund Association (PBHFA) in March 2018 March 25, 2018 - A PBHFA staff member wrote: Our March 22, meet & greet, deal-making social was a tremendous success! Our...

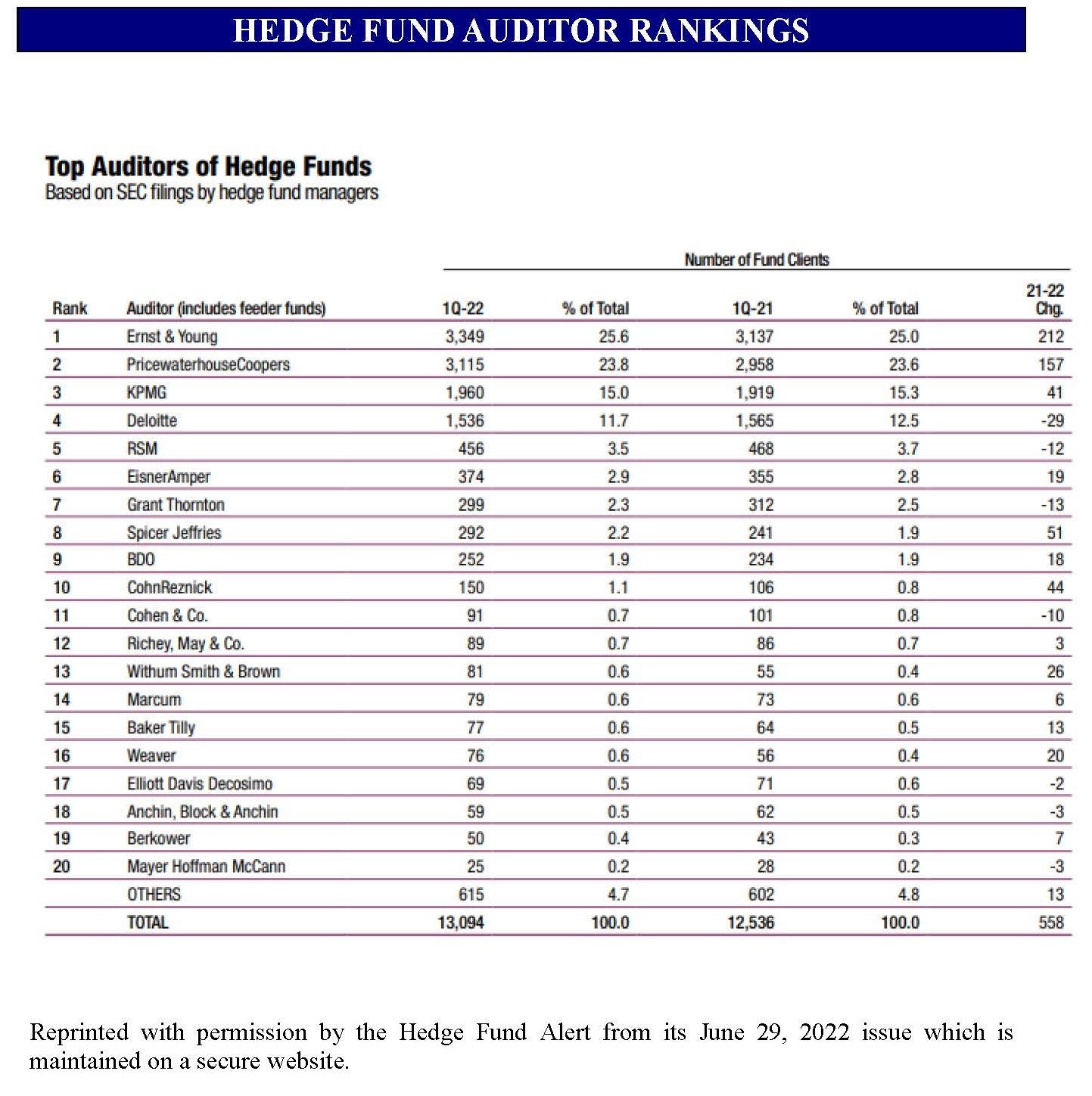

moreSpicer Jeffries LLP Ranks Among Top 10 Hedge Fund Auditors

August 10, 2019SJ is proud to be ranked among the Top 10 Hedge Fund Auditors by the HedgeFund Alert. For seven consecutive years, 2014 through 2020, Spicer Jeffries has continued its dedication to the securities industry and the Alternative Investment space. These rankings...

moreSpicer Jeffries Ranks Among TOP 10 Fund Auditors

For the 9th consecutive year, Spicer Jeffries LLP has ranked among the TOP 10 Fund Auditors of the HedgeFundAlert.com annual rankings. This success would not have been realized without the support of our valued clients and leading industry members, as well as our dedicated employees.

The complete list of Fund Auditor rankings and other service provider rankings may be found through the HedgeFundAlert.com website and viewing the annual rankings. Historical data is also provided. https://hedgefundalert.com/